How New 1099-K requirements Rules Positively Impact Gig Workers in 2025

The landscape of the modern workforce is undergoing a seismic shift. The traditional 9-to-5 is no longer the only path to a successful career. Today, millions of people are embracing the freedom, flexibility, and entrepreneurial spirit of the gig economy.

As freelancers, independent contractors, and online sellers, you are the architects of your own success. However, this autonomy comes with a crucial responsibility: navigating the complex world of taxes.

A significant change is solidifying its place in this new economy, centered around a single tax document: Form 1099-K. It is essential to deeply understand the updated 1099-K requirements 2025 gig economy participants will face. This is not just a minor tweak to a tax form; it represents a fundamental shift in how income is reported to the IRS, and it will affect millions of self-employed individuals.

This ultimate guide will serve as your playbook. We will break down precisely what is changing, explore the historical context of these rules, analyze the profound impact on gig workers, and provide a detailed, step-by-step checklist to ensure you are not just compliant, but confident and prepared for a smooth tax season in 2025 and beyond.

Section 1: Decoding Form 1099-K – Why Does It Exist for Gig Workers?

Before diving into the changes, it’s critical to understand the form itself. What is its purpose, and who is responsible for sending it?

Form 1099-K, officially titled “Payment Card and Third Party Network Transactions,” is an information return filed with the IRS. Its primary function is to report payments for goods and services received by a business or individual through specific channels. The entities required to send this form are known as Third-Party Settlement Organizations (TPSOs).

In simple terms, a TPSO is a company that facilitates payments between a buyer and a seller. For the gig economy, this includes nearly every platform you use to earn a living:

- Peer-to-Peer Payment Apps: PayPal, Venmo, Cash App (when used for business transactions).

- E-commerce Marketplaces: Etsy, eBay, Amazon Marketplace, Shopify (which uses Stripe or PayPal).

- Freelance Platforms: Upwork, Fiverr, Toptal.

- Rideshare and Delivery Services: Uber, Lyft, DoorDash, Instacart.

- Creative and Creator Platforms: Patreon, Kickstarter.

- Payment Processors: Stripe, Square.

When you earn money through any of these platforms, they are required by law to send a Form 1099-K to both you and the IRS once your earnings cross a specific annual threshold.

The core purpose of this form, from the IRS’s perspective, is to close the “tax gap”—the difference between taxes legally owed and the amount actually collected. By receiving a direct report of your gross income from the platforms you use, the IRS gains visibility into a significant portion of the economy that was previously harder to track.

It is absolutely crucial to remember this key fact: Form 1099-K reports your gross income. This is the total, unadjusted amount of money that flowed through the platform on your behalf. It does not account for platform fees, shipping costs, supplies, mileage, or any other business expenses. You are responsible for tracking those expenses separately to calculate your actual, taxable net profit.

Section 2: The Big Change – Old Rules vs. The New 2025 Threshold

The recent confusion and discussion around Form 1099-K stem from a dramatic and long-planned change to its reporting threshold. Understanding this evolution is key to appreciating the current landscape.

The Legacy Rule: The High Bar of $20,000 and 200 Transactions

For many years, the threshold for receiving a 1099-K was quite high and included two distinct parts. A platform was only obligated to issue the form if a user met both of the following criteria within a single calendar year:

- Received more than $20,000 in gross payments.

- Processed more than 200 individual transactions.

This dual requirement meant a massive number of part-time gig workers, casual online sellers, and freelancers with a few high-value clients never received the form. For example, a graphic designer who completed 10 projects for

1,900each(1,900each(19,000 total) would not receive a form. Similarly, an Etsy seller with 500 sales totaling $15,000 would also not receive one. You had to clear both hurdles.

The Planned $600 Shockwave and Subsequent Delays

The American Rescue Plan Act of 2021 included a provision to drastically lower this threshold to just $600, with no transaction minimum. This was intended to take effect for the 2022 tax year. The announcement sent shockwaves through the gig economy and caused widespread confusion. Taxpayers worried they would receive forms for personal reimbursements, and platforms struggled to prepare for the massive increase in reporting.

Recognizing the potential chaos, the IRS announced a delay, pushing back the implementation. They delayed it again for the 2023 tax year, citing the need for a smoother transition.

The New Phased-In Threshold for the 2024 Tax Year (Reported in 2025)

After the delays, the IRS established a new, transitional threshold as part of a phased-in approach. This is the rule that is in effect now.

For the 2024 tax year, the taxes you will file in early 2025, the new official requirement is:

You will receive a Form 1099-K if you receive more than $5,000 in gross payments from a single third-party payment network.

This is a monumental reduction from the old rule and carries two critical implications:

- The Monetary Threshold is 75% Lower: Dropping from $20,000 to $5,000 immediately pulls millions of previously non-reporting earners into the formal system.

- The Transaction Count is Gone: The 200-transaction requirement has been completely eliminated for this threshold. Whether you earn $5,001 from one single project or from 1,000 tiny sales, you will receive the form.

It is important to view this $5,000 threshold as a stepping stone. The IRS has publicly stated its intention to eventually lower the threshold further toward the originally planned $600. Therefore, the preparation habits you build now will be essential for future tax years.

Section 3: Understanding the “1099-K Requirements 2025 Gig Economy” Impact

This change in the 1099-K requirements 2025 gig economy workers must follow will have a widespread and multifaceted impact. It’s more than just a new form in the mail; it represents a shift in financial diligence and awareness.

1. More Gig Workers Will Receive Form 1099-K

This is the most direct consequence. The vast majority of individuals earning a supplementary income will now cross the reporting threshold. If you drive for a rideshare service a few nights a month, sell your crafts online as a hobby-turned-business, or take on freelance writing projects in your spare time and earn over $5,000 through one platform, you can expect to find a 1099-K in your physical or digital mailbox by January 31, 2025.

2. Increased IRS Visibility and Automated Matching

With this lower threshold, the IRS’s automated systems will have far greater visibility into the income generated within the gig economy. The IRS computer system performs a process called automated matching. It takes the information from third-party forms like the 1099-K and compares it to the income you report on your tax return (specifically, on your Schedule C for business income).

If the gross income you report is less than the amount on the 1099-K you received, the system will automatically flag the discrepancy and likely issue a CP2000 notice. This notice is not a formal audit, but it proposes a change to your tax liability based on the mismatched information and can be stressful and time-consuming to resolve. Accurate reporting is no longer just good practice; it’s a necessity to avoid automated scrutiny.

3. No Actual Change in Your Fundamental Tax Liability

This point cannot be overstated. It is a common and dangerous misconception that receiving a 1099-K creates a new tax or means you will pay more in taxes. This is false.

You have always been legally required to report all income you earn, from any source, whether you received a tax form for it or not. The 1099-K is simply a reporting tool that enforces this existing obligation. Your tax bill is calculated on your net profit, not the gross amount on the form.

Example:

An online vintage seller receives a 1099-K from Etsy for $9,000. This is her gross revenue.

Throughout the year, she meticulously tracked her business expenses:

- Cost of goods sold (what she paid for the vintage items): $3,500

- Shipping supplies (boxes, tape, labels): $800

- Etsy transaction and listing fees: $900

- Marketing (social media ads): $400

- Home office deduction (a portion of her rent and utilities): $600

Total Expenses: $6,200

Net Profit: $9,000 (Gross) – $6,200 (Expenses) = $2,800

She will pay income tax and self-employment tax on her $2,800 profit, not the $9,000 reported on the 1099-K. The form was the starting point, but her diligent expense tracking is what determined her actual tax liability.

Also Read: Effortlessly Master Your Quarterly Taxes as a Freelancer: The Ultimate Step-by-Step Guide

Section 4: Your Ultimate Preparation Playbook for the 2025 Tax Season

Adapting to the new 1099-K requirements 2025 gig economy participants must follow is entirely about proactive preparation. Do not wait until your tax forms arrive in January. The work you do today will determine your peace of mind tomorrow. Here is your comprehensive checklist.

1. Track Your Income Meticulously

Do not rely on the 1099-K as your sole source of truth. Keep your own independent, detailed records of all income from all sources. This allows you to verify the accuracy of the forms you receive and catch any potential discrepancies. Your income log should include the date, source (platform), and amount of every payment.

2. Become an Expert Expense Tracker

This is the single most powerful way to legally reduce your tax bill. The key to lowering your tax burden is to deduct every eligible business expense. A missed deduction is like leaving money on the table. Use a spreadsheet, a dedicated app, or accounting software to keep detailed, organized records of every single business-related expense. Keep digital copies of all receipts.

Common Deductible Expenses for Gig Workers:

- General Business Expenses:

- Home Office Deduction: A portion of your rent/mortgage, utilities, and internet if you have a dedicated workspace in your home.

- Business Use of Your Phone: The percentage of your monthly phone bill that corresponds to business use.

- Software and Subscriptions: Accounting software (QuickBooks), project management tools (Asana), design software (Adobe Creative Cloud), etc.

- Business Bank Account Fees.

- Education and Training: Courses, workshops, or books related to improving your professional skills.

- Marketing and Advertising Costs.

- For Rideshare/Delivery Drivers:

- Mileage: Track every business mile driven. You can use the standard mileage rate (e.g., 67 cents per mile for 2024) or the actual expense method.

- A portion of car insurance, registration, and maintenance.

- Car cleaning supplies, phone mounts, and passenger amenities (water, snacks).

- For Freelancers (Writers, Designers, etc.):

- Computer and Office Equipment.

- Website Hosting and Domain Fees.

- Professional Association Dues.

- Contractor Payments (if you hire a subcontractor).

- For Online Sellers (Etsy, eBay):

- Cost of Goods Sold (COGS): The original cost of the items you sell.

- Shipping and Postage Costs.

- Packaging Supplies (boxes, mailers, tape, labels).

- Platform Fees (listing fees, transaction fees, payment processing fees).

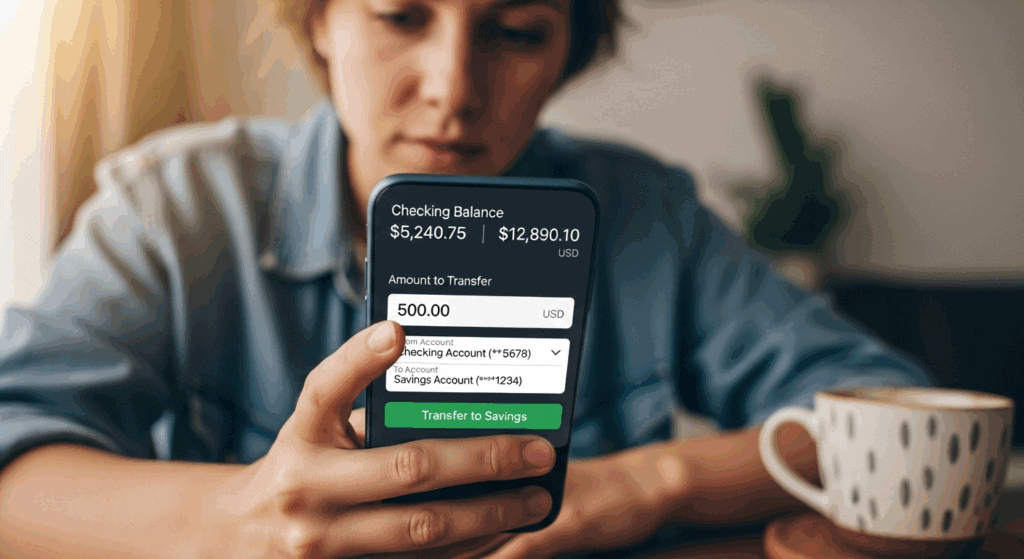

3. Separate Business and Personal Finances

This is non-negotiable for any serious gig worker. Open a separate business checking account and a business credit card.

- Clarity: It creates a clean, undeniable record of your business income and expenses. There is no commingling of personal and business transactions.

- Simplicity: At tax time, you simply need to review the statements from these two accounts. You won’t have to painstakingly comb through hundreds of personal transactions to find the business-related ones.

- Audit Protection: In the unlikely event of an audit, separated finances demonstrate a high level of professionalism and make it much easier to justify your reported income and deductions.

4. Set Aside Money for Taxes and Understand Self-Employment Tax

As a gig worker, you are both the employee and the employer. This means taxes are not automatically withheld from your pay. You are responsible for paying them yourself. This includes:

- Federal and State Income Tax.

- Self-Employment Tax: This is the self-employed version of FICA taxes (Social Security and Medicare). For 2024, the rate is 15.3% on the first $168,600 of net earnings.

A common and safe rule of thumb is to set aside 25-30% of your net earnings in a separate savings account specifically for taxes. This ensures you have the cash on hand when it’s time to pay. If you expect to owe more than $1,000 in tax for the year, you are generally required to make quarterly estimated tax payments to the IRS using Form 1040-ES.

5. Consult a Tax Professional

If you’re feeling overwhelmed or if your financial situation is complex, hiring a qualified tax professional (like a CPA or an Enrolled Agent) is an investment, not an expense. They can help you navigate the complexities of self-employment tax, identify every possible deduction you’re entitled to, and ensure your tax return is filed accurately and on time.

Expanded Frequently Asked Questions (FAQs) for the 1099-K Rule Changes

Here are detailed answers to the most common questions about the new rules.

1. What are the specific 1099-K requirements for the 2024 tax year (filed in 2025)?

For the 2024 calendar year, a third-party settlement organization (like PayPal, Stripe, or Uber) is required to send you a Form 1099-K if they processed more than $5,000 in gross payments on your behalf. This threshold applies on a per-platform basis and has no minimum transaction count. This is a significant change from the previous federal threshold of $20,000 and 200 transactions. This new rule will result in millions more gig workers and online sellers receiving the form for the first time in early 2025.

2. Does meeting the new 1099-K requirements and receiving a form mean I will pay more in taxes?

Not necessarily. The 1099-K is a reporting tool, not a new tax. You have always been legally required to report all income you earn, regardless of receiving a form. The new rule simply increases the likelihood that your income will be formally reported to the IRS. Your actual tax bill is calculated on your net profit, which is your gross income (the amount on the 1099-K) minus all your deductible business expenses. If you have been correctly reporting all your income and expenses all along, your tax bill should not change. If you have been underreporting, this new rule will compel you to report more accurately, which could result in a higher tax bill, but one that reflects your true legal obligation.

3. What happens if I use multiple platforms and don’t make $5,000 on any single one?

The $5,000 threshold is applied on a per-platform basis. Each company only reports the payments they processed for you. For example, if you earned $4,500 on Upwork, $3,000 on Etsy, and $2,500 through DoorDash during 2024, you would not receive a 1099-K from any of them, because you didn’t meet the $5,000 threshold on any single platform. However, you are still legally obligated to report your total self-employment income of

10,000(10,000(4,500 + $3,000 + $2,500) on your tax return. Relying on 1099-K forms as your sole method of income tracking is a critical mistake that can lead to underreporting and potential penalties.

4. What should I do if my 1099-K includes personal payments, like money from friends for dinner?

Form 1099-K is intended only for payments for “goods and services.” If your form incorrectly includes personal, non-taxable payments (like reimbursements from friends), you must address this correctly on your tax return to avoid paying tax on it. First, keep meticulous records proving which transactions were personal. On your Schedule C, report the full 1099-K amount on the “Gross Receipts” line. Then, on a separate expense line, deduct the total amount of personal payments with a clear description like “Non-taxable personal payments reported on 1099-K.” This method acknowledges the IRS form while correcting the taxable income figure. Consulting a tax professional is highly recommended in this scenario.

5. What is the most important step I can take now to prepare for these new 1099-K requirements?

The most crucial step you can take is to start tracking your income and expenses meticulously right away. Do not wait until January 2025. Treat your gig work like a real business. The best way to start is by opening a dedicated business bank account to separate your finances. Then, choose a system—whether it’s a simple spreadsheet, an app, or accounting software like QuickBooks Self-Employed—and log every single business-related transaction, both income and expenses. This proactive habit is the foundation of a stress-free tax season and ensures you are fully compliant and prepared.

Conclusion: Proactive is Better Than Reactive

The shift to a $5,000 1099-K threshold is more than a regulatory update; it’s a call to action for every participant in the gig economy to professionalize their financial habits. While the prospect of new tax forms and increased IRS visibility may seem daunting, it is entirely manageable with proper planning and diligent record-keeping.

By understanding the new 1099-K requirements 2025 gig economy workers are subject to, you transform potential anxiety into empowerment. View this not as a burden, but as an opportunity to gain true mastery over your business finances. Start tracking your income and expenses diligently today. Separate your accounts, save for your taxes, and embrace the tools that make this process simple. By doing so, you will approach the 2025 tax season not with fear, but with the confidence of a true entrepreneur.